Treasury Management

Introduction

As Decentralized Autonomous Organizations (DAOs) scale, so too does the importance of effective treasury management. A DAO’s treasury is crucial to the longevity of the organization as it holds the financial fuel for future development and growth. DAOs have begun to experiment with different ways of employing capital in their treasuries – LP subsidies, M&A, token buybacks, protocol development, compensation for contributors, etc. – each of which can contribute to furthering the DAO’s mission. Forming a treasury that allows the DAO to weather black swan events and cyclical bear markets is critical to ensuring that the DAO is able to accomplish stated goals.

The two biggest problems that DAOs face today regarding treasury management are diversification and liquidity provisioning. 1. This piece will dive deeper into both.

Note that these two specific problems are relevant for protocol DAOs that have issued ERC-20 tokens, like Uniswap, Aave, and Compound. Other DAOs, like Nouns DAO, have different underlying mechanisms (e.g. Nouns DAO does a continuous NFT auction rather than a one time ERC-20 token distribution) and face different treasury management issues than protocol DAOs.

What is a DAO?

DAOs are a novel coordination mechanism. These internet-native organizations utilize immutable smart contracts deployed on public blockchains rather than traditional legal contracts to implement the rules that govern the organization. A collective group of members come together in a digitally-native way to communally direct the DAO forward. A DAO’s mission can be something as simple as a group of people attempting to purchase a copy of the U.S. Constitution (Constitution DAO), or the mission can be as nuanced as a group of people managing the deployment of product upgrades for a decentralized exchange (i.e. Uniswap, Sushiswap). There are different ways to participate in DAOs, but the most common method is through the purchase of the DAO’s governance/native tokens, which typically allows holders to participate in governance activities. Uniquely, the ledger of token ownership, the balance of the DAO’s treasury wallet, and the participation of stakeholders in the voting process are recorded on public blockchains.

While some aspects of DAOs can be very different from the traditional methods of organizing around a common purpose, the treasury management needs between DAOs and traditional corporate structures share many similarities. One shared critical requirement is the need for capital to fund operations of the organization to fulfill the stated mission of the group. Depending on the specific governance mechanisms of a given DAO, members can decide how to spend the DAO’s funds.

The goal of a DAO treasury is to help ensure the growth and longevity of the organization by powering its daily operational needs, while allowing long-term investments into growth and innovative protocol upgrades. However, reaching consensus on how to strategically manage millions (and sometimes billions) of dollars is not an easy task, and DAOs have struggled to properly manage their treasuries.

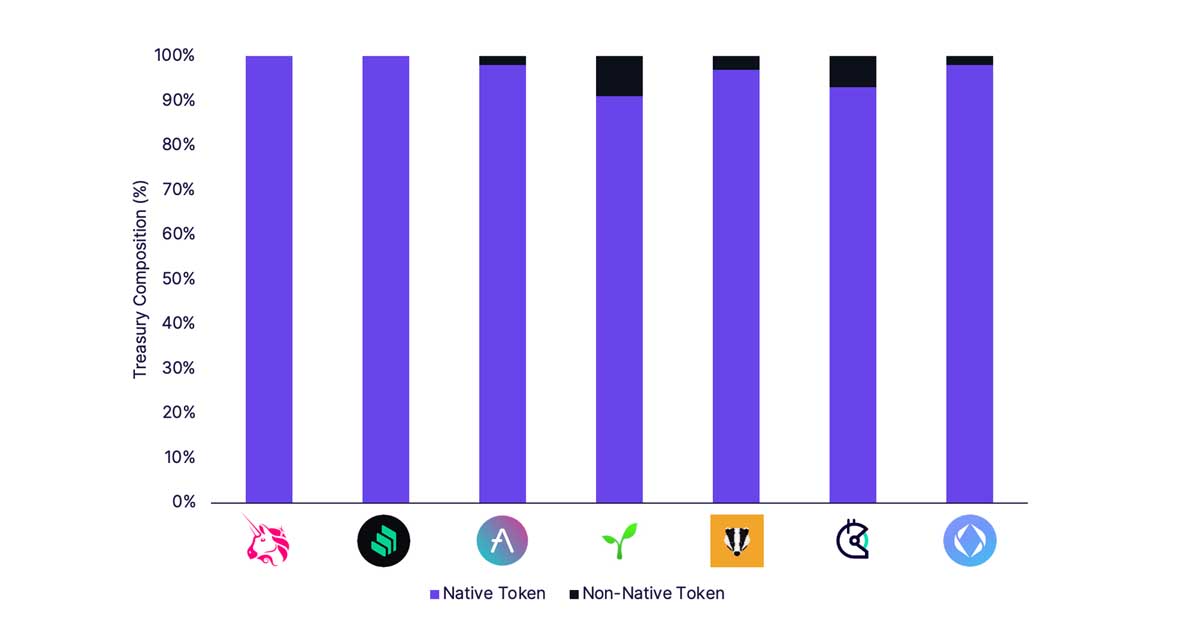

What DAO treasuries currently look like

Today, it is common to see concentrated DAO treasuries, where most of the assets are in the form of the DAO’s native token. A deeper look into Uniswap, a decentralized exchange that is arguably the most well known decentralized finance product, illustrates the problem.

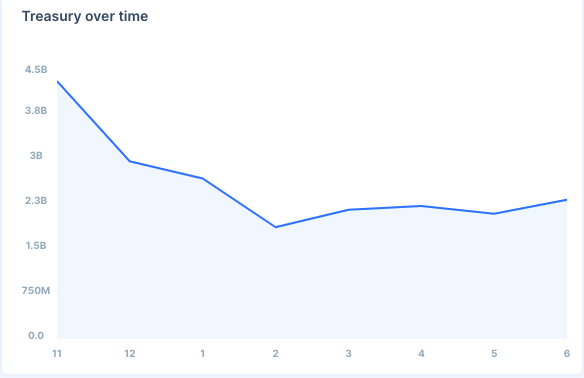

At the time of writing, the Uniswap DAO has a treasury of ~$2.3B, which is essentially 100% held in the native $UNI governance token. As a result, Uniswap’s treasury fluctuates essentially 1:1 with the price of $UNI. Another example of this concentration is Compound, a leading decentralized money market protocol. 94% of Compound’s ~$172M treasury is held in $COMP tokens which, like $UNI, experiences significant volatility day-to-day.

To some extent, a DAO holding native tokens makes sense — this can act as a signal to stakeholders that the organization has strong conviction in its mission, and it allows the opportunity for the DAO treasury to capture upside from potential price appreciation alongside the organic growth of the DAO (especially in cases where the DAO organizes to produce a community-owned protocol, like UNI and COMP). However, when the price of their native token drastically falls, the DAO can be stuck in a precarious position.

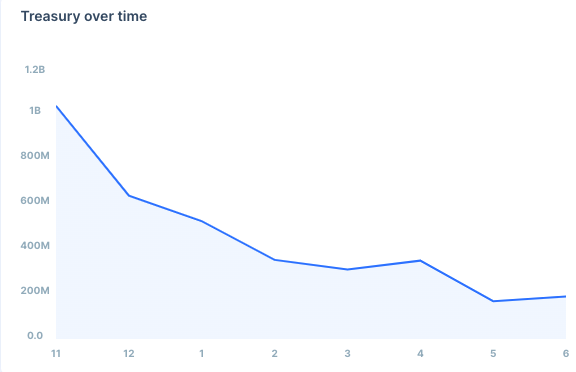

Uniswap treasury composition and size over time

Compound treasury composition and size over time

Why is this a problem?

A headline like “Stripe loses 50% of balance sheet, cutting runway by half” would cause mayhem in the corporate world. Unfortunately, this seemingly unrealistic scenario happens frequently with DAO treasuries. When the inevitable crypto bear market approaches, many treasuries quickly deplete in value due to the volatile nature of the underlying token and the concentrated composition of the DAO treasury.

However, low trading prices of the native token do not equate to low expenses for the organization as it continues to pursue the stated mission of the DAO — protocol developments and community growth needs do not come to halt during bear markets. As a result, it becomes difficult for the DAO to keep up with these expenses when their treasury, which is expected to fund these expenses, depletes by significant amounts from asset price changes.

Another look into Uniswap’s treasury shows the gravity of this problem. Uniswap had a treasury size of ~$5B at its peak in 2021. The current treasury size is now down ~$2.5B (approx. 50%) from this peak due to $UNI’s price drop. These losses serve as financial barriers to a DAO’s achievement of its stated mission and can expedite the fall of the DAO as well. This can be largely avoided with effective treasury management. So what can DAOs do today to avoid the consequences of a poorly managed and idle treasury?

Diversification

Why diversify?

De-risk treasury

Diversification significantly mitigates the unsystematic risk of the treasury (i.e. the risk unique to each individual asset, rather than the risk related to the market on the aggregate), as the treasury’s volatility will no longer be directly correlated to just one asset. Native tokens can still easily fall over 70% in a short amount of time, cutting DAO treasuries and runways by a significant amount. Diversification into less risky assets will provide DAOs longer runways with its resistance to volatility.

Manage predictable budget

Subgroups within a DAO (i.e. working groups and grants committees) are given a certain amount of native tokens for their expenses. Accounting for the price fluctuation of the asset makes it difficult for the subgroups to accurately predict the size of their budget. On top of the subgroups’ primary tasks, the subgroups essentially need to take on the roles of a treasury manager as they are given such highly volatile assets to work with. These subgroups should be laser focused on their primary tasks for the DAO’s efficiency and this can be achieved with proper diversification.

Pay contributors

The introduction of stablecoin payments expands the pool of contributors. Many contributors and potential contributors have expenses that need to be paid punctually, and this would be much more easily handled through non native tokens like fiat/stables. The volatility of native tokens actually can drive away quality yet risk averse contributors. Giving contributors the option to be either partially or fully paid in assets like fiat/stables will de-risk the industry and allow these risk averse contributors to participate.

This stability also helps DAOs maintain credibility as it becomes easier for them to keep up with their payment promises with non native token assets. DAO contributor payment timelines are different per DAO. However, many DAOs will promise to pay contributors after the work is completed, which can become difficult if their budget has drastically fallen since the initial agreement.

Liquidity provisioning for low risk yield

As mentioned earlier, DAOs can provide stablecoin liquidity to DeFi protocols and reap the liquidity provisioning rewards. For example, Uniswap does this by providing liquidity on v3 stablecoin pools to deepen liquidity and earn transaction fees. However, despite its name, this path still has its risks. Providing stablecoin liquidity is subject to stablecoin depegging/devaluation and smart contract failure, which would result in losing the principal amount provided.

How to diversify

Token sales

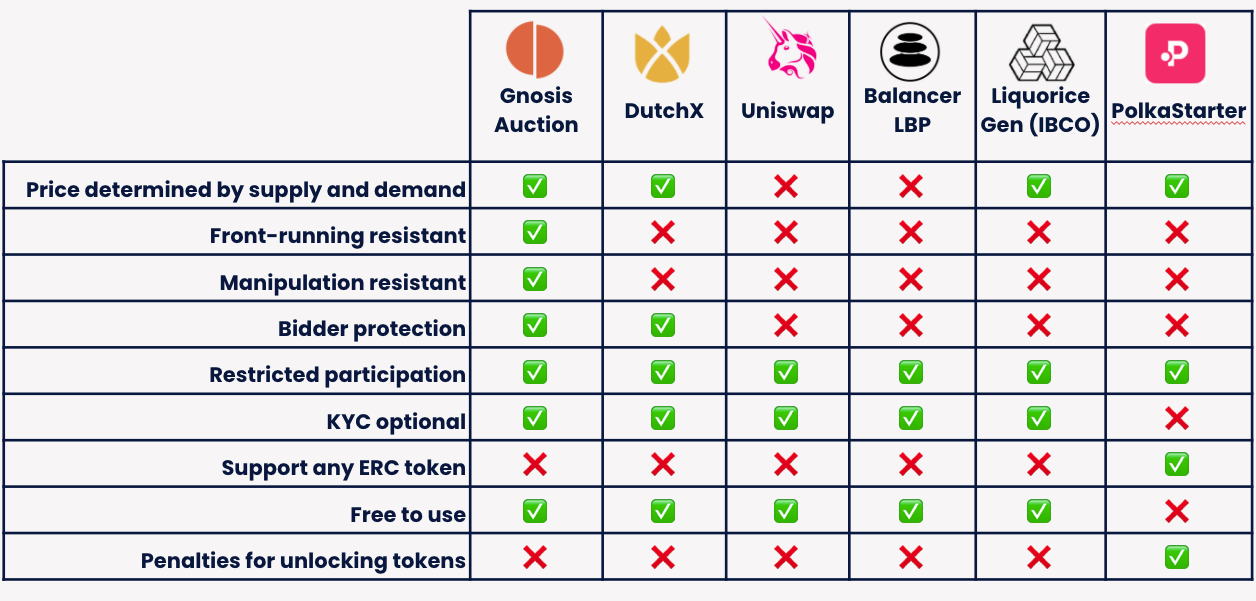

Since DAOs typically contain some sort of voting mechanism based on on-chain ownership of the DAO’s native token, an initial distribution of the native token needs to occur. The most straightforward way a DAO can then go about changing its treasury is through an additional token sale. However, a token sale is controversial due to the technical and qualitative implications it may carry.

First, a large token sale often impacts the token’s price, due to the sheer volume of tokens held in a DAO’s treasury. Massive sales of treasury tokens will likely experience significant price slippage — a 1% liquidation of Uniswap’s treasury would create a slippage of over 95%, due to market demand relative to the size of the sale. Second, token sales can signal to current investors and potential investors that the DAO does not have conviction in its mission (similar to the concept of incentive alignment via ownership of private, illiquid startup equity when working at or founding a startup).

However, many DAOs are formed to advance an explicit mission. Uniswap, for example, states that “The Uniswap Protocol is a public good owned and governed by UNI token holders”, signaling the view that the DAO’s mission is to govern the public good. Gitcoin, an organization created to fund open source projects, stated in their initial token allocation post that “The DAO is the vessel for Gitcoin’s mission”. The growth of these DAOs, as it pertains to pushing forward their stated missions, is driven by initiatives that are more often than not fueled by capital, which should be easily accessible from a DAO’s treasury. Therefore, if the rules governing the DAO allow for it and the community surrounding the DAO supports it, the DAO should do its best to clearly communicate the reasoning behind an additional token sale by highlighting the importance of treasury diversification for the long term success of the DAO. This could include detailed outlines on fund allocation, explanations of how certain initiatives will help grow the DAO, and the token sale mechanism (these tokens can be sold either publicly or privately).

Note that a DAO should speak with qualified lawyers and tax experts before it proceeds with any diversification.

Public sales — Decentralized Exchanges (DEXs)

This is the most transparent way to go about selling tokens, since everything happens publicly and on chain. A DAO can simply go to a DEX like Uniswap and convert its native tokens into the assets it wishes to diversify into at a spot price. However, the aforementioned price impact and slippage would pose significant problems. On top of price impact, a prolonged sale could also open opportunities for insider trading issues like front-running.

Public sales — OTC & Market Makers

This is less transparent than trading directly on a DEX; however, there are benefits to going over-the-counter. Market makers can help execute trades in a more efficient manner, potentially avoiding the price impact of a public sale. For example, Wintermute was able to convert Vitalik’s $1B Shiba Inu donation to Crypto Relief into USDC. The DAO may require an agent to act on their behalf and ensure the transactions execute according to both parties’ agreement, and the DAO usually pays fees to the market maker.

Public sales — Batch Auctions

Batch auctions and projects like Gnosis Auction allow all participants to receive the same uniform price by matching the limit orders of buyers and sellers, grouping individual orders, and executing them simultaneously. These auctions can be completely executed on chain and are resistant to insider trading problems (i.e. front-running and sandwiching) as the sales are all executed at once. This method will be more time intensive in terms of preparation and execution. Also, there must be enough people willing to participate in the auction for this option to make sense.

Private sales / private investors

Token sales to properly aligned private investors is another path that DAOs can take to diversify their treasury. Tokens are usually sold at a discounted price, which could dilute current tokenholders’ ownership. This leads to some questioning the necessity of private investors. However, the right private investors can be valuable to the growth of the DAO, and investments from certain investors can signal a DAO’s legitimacy. This sale would most likely come from a governance proposal that outlines the pros and cons of the method.

Operating income/revenue

This is only relevant if the protocol or DAO generates revenue. Many DeFi protocols generate revenue, usually through a fee model, from the services provided to users. If this revenue or a portion of this revenue generated already flows into the treasury, then the only step left is to diversify the assets flowing in. For example, Yearn Finance charges a 20% performance fee deducted from the generated yield, and a 2% management fee for their yVaults. These fees, which flow directly to the Yearn treasury, can easily be collected in other assets like stables or blue chip crypto assets.

Some of the DAOs that organize around a product, like Uniswap and Compound, don’t have revenue streams currently built into the product. This is partially philosophical (i.e. the idea that blockchain-based protocols shouldn’t charge any fee) and partially practical (i.e. the idea that charging a fee will push consumers to the many no-fee options). While this piece doesn’t have an opinion on the debate, this issue is being debated currently at Uniswap. Many Uniswap governance participants have argued that the built-in fee switch (currently turned off) should be turned on so that the DAO can generate revenue and produce a sustainable income stream. This could be used to build a more robust and diversified treasury. This would be a strictly additive way of diversifying the treasury; no tokens from the current treasury would be sold, meaning no dilution of ownership for existing token holders. In fact, Uniswap is currently voting on potentially initiating a trial with a 1 bps fee tier on an Optimism pool.

Raising debt

Similar to corporations, DAOs can raise debt. However, most DAOs only have their own native assets to put up as collateral. This usually leads the lender to require heavy overcollateralization, in the event of adverse market conditions leading the collateral to dip in value, which could then lead to a liquidation.

Debt — Unsecured (no collateral or undercollateralized)

There are not too many ways to acquire unsecured debt in the DeFi space today. One commonly known method is a flash loan. Flash loans allow borrowers to instantly borrow large amounts of assets with no collateral under the assumption that the loan is repaid within the same transaction (almost immediately). Flash loans are commonly used to capitalize on arbitrage opportunities, fund collateral swaps, or even to refinance debt. An unpaid loan will result in the smart contract reversing the transaction, as if the funds were never sent to the borrower in the first place. DeFi protocols such as Aave, dYdX, and Uniswap all offer/offered flash loans. Projects are working to create other ways of acquiring unsecured debt in DeFi.

Debt — Secured (collateralized)

Secured debt involves some sort of collateral put up by the debtee/borrower for them to borrow funds. The lender usually has specific assets that are accepted as collateral. Similarly, in DeFi protocols, the number of assets accepted as collateral are very limited, so most DAOs cannot acquire secured debt, as the current state of treasuries shows that most lack the accepted assets. The DAOs that do have the necessary assets will have to put up their tokens for an overcollateralized loan.

Assets to diversify into

Stablecoins

Stablecoins are a cryptocurrency that has its value tied to another asset such as the United States Dollar (USD). The goal of a stablecoin is to present a stable peg to the value of an underlying asset while creating a digital representation of that asset that can then be used in decentralized finance and other blockchain use cases. Different stablecoins maintain their values in unique ways, resulting in unique levels of risk. Fiat-backed stablecoins like USDC maintain their peg with an equal fiat reserve. This means that USDC stablecoins can only be issued up to or equal to the USD amount present in their reserve. This allows USDC holders to trade in their stablecoins for USD at any time. However, other stablecoins may not have real assets backing it. Algorithmic stablecoins like Terra solely use smart contracts and algorithms to control their price. The lack of a collateral imposes higher risk into the system and can create heavier volatility with the stablecoin’s value, which can be seen with Terra’s recent depegging. Overall, stablecoins are generally seen as an asset that is able to weather times of heavy depreciation, which is invaluable in a volatile industry like cryptocurrency.

Blue chips (Bitcoin and Ethereum)

Many DeFi protocols only accept certain assets for collateral or its services (i.e. lending protocols like Aave and Compound), and the two major blue chip crypto assets, Bitcoin and Ether, are usually accepted as collateral. Also, the volatility of blue chip crypto assets tend to be a bit lower than crypto assets with smaller market caps, which could help with the overall treasury’s volatility. Finally, these assets are the most liquid assets in the space, so it is less likely for there to be high slippage when DAOs exit their ETH/BTC positions. This is in contrast to the native tokens of DAOs as evidenced by the aforementioned 95% slippage on $UNI trades.

Non-blue chip crypto assets

DAOs may independently acquire another DAO’s native tokens if they want to participate in that DAO. However, there may be less of a benefit in treasury diversification for acquiring each other’s tokens as most non-blue chip crypto assets are often highly correlated. Another way a DAO could have another DAO’s native assets is through a token swap. One of the reasons DAOs justify token swaps is on the basis that they have potential synergies with the swapping counterparty. The Fei-Rari merger is a great example of two DAOs successfully executing a merge as a result of perceived synergies.

Treasury diversification tools (i.e. UMA Protocol)

UMA protocol allows any two parties to produce their own financial contract, which can be tailored to their needs. Their financial products can be leveraged by DAOs to diversify their treasury.

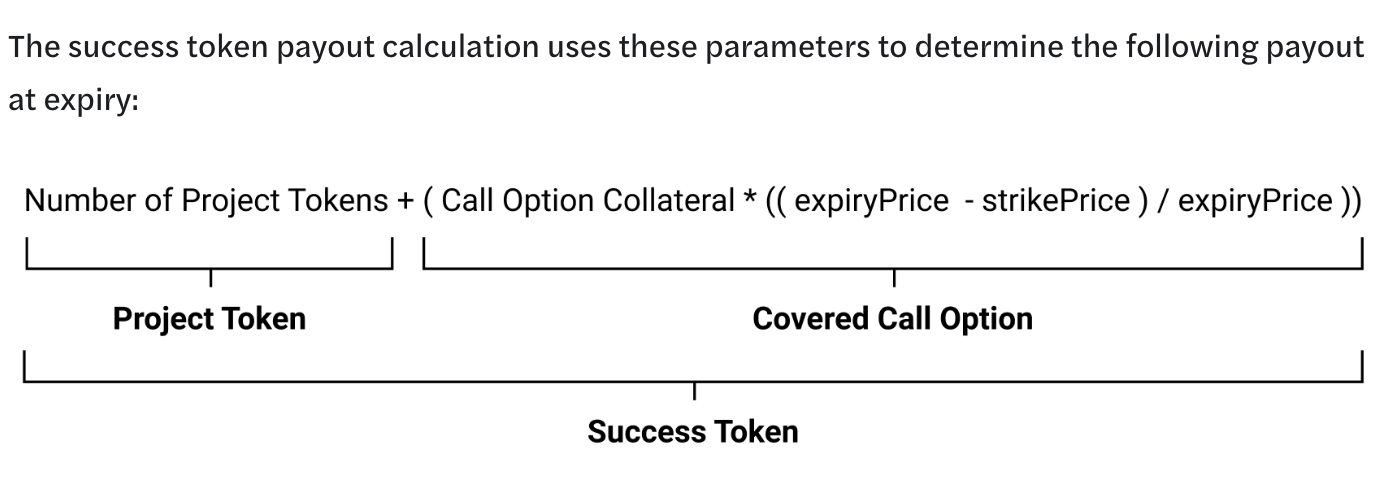

Success Tokens

Success Tokens have two products wrapped in them — a predetermined amount of a token and a covered call option for that token. The token and call option are both locked until the vesting date, similar to a normal vesting schedule. The call option gives investors the upside exposure that private investors look for but only if the DAO is doing well. This means that private investors are able to capture value only at the same time as regular token holders do. Both private investors and regular token holders are at the same starting point, incentivizing both parties to help the project do well. Benefits of Success Tokens include:

- Nice product for DAOs that want to avoid token sales to private investors due to the discount the investors receive them at, while attaining VC expertise.

- DAOs can borrow funds without a liquidation risk.

- The nature of a call option means that the token is being sold at a higher valuation.

Range Tokens

Range Tokens serve as convertible debt that allows DAOs to put up their native tokens as collateral. This way, DAOs maintain the same level of exposure to their native tokens while having access to more immediate capital.

Liquidity provisioning

Liquidity mining incentives

Liquidity is the fuel for Web3 and DeFi protocols. Traditional financial liquidity is broadly defined as the ease with which one can convert their assets into cash. Similarly, liquidity in DeFi is required to allow users to convert tokens into another token in a transfer of value. Liquidity levels can be analyzed through its “depth”. Deep liquidity means that there is an abundance of the needed tokens to trade into, minimizing price impact and retaining as much value as possible. On the other hand, “thin” liquidity will cause tokens to be sold at a premium due to its scarcity, increasing price slippage and causing traders to lose value when trading between assets. As a result, many DeFi protocols give liquidity providers financial incentives to reach the liquidity levels needed for the protocol’s seamless functionality and user experience. DAOs can take advantage of other protocols’ liquidity mining incentives by using assets in their treasuries to provide liquidity on other protocols and reaping the liquidity provision rewards, which can then be used to diversify the treasury.

However, this model has since been scrutinized for attracting mercenary capital, thereby preventing the protocol and DAO’s long term success. “Yield farmers” will quickly move their capital to the place that provides them with the most liquidity mining rewards — 42% of yield farmers will exit a position within 24 hours, while 16% leave within 48 hours, and 70% of users have completely withdrawn by the third day. This model, pioneered by Compound, generated the idea of a “race to the bottom” as protocols attempt to ‘one-up’ each other in financial incentives to attract liquidity providers. This quickly dries up capital and leads to large fluctuations in the liquidity on platforms.

Liquidity innovations

As more people have realized the problems inherent in traditional liquidity mining incentives, new innovations and projects regarding liquidity provisions have been developed. This development can be largely classified as DeFi 2.0. Currently, projects can either rent (i.e. Liquidity as a Service) or directly buy (i.e. Protocol Owned Liquidity / Protocol Controlled Value / Protocol Controlled Assets) their liquidity.

Liquidity innovations — Liquidity as a Service (Fei, Ondo)

Fei Protocol partnered with Ondo Finance to create a new Liquidity as a Service offering. The service will utilize Ondo’s liquidity vaults to accept native tokens from DAOs on a flexible timeline. Then, Fei Protocol will match the deposit made by the DAO with newly minted FEI (the stablecoin supported by Fei Protocol and backed by its PCV) for a new liquidity pair on DEXs. The liquidity that a DAO can now use for its protocol is doubled with the removal of upfront capital costs. This extra liquidity creates a more robust market with less slippage for all consumers buying or selling the token. When the vault timeline comes to an end, the vault returns the FEI to Fei Protocol with a small fixed fee and returns the remaining native tokens back to the DAO along with the trading fees earned. The downside is that there is zero protection from impermanent loss. This sheet can be used to determine sensitivity based on custom inputs and assumptions for those looking to use this service.

Liquidity innovations — Protocol Owned Liquidity (Olympus Pro)

Olympus Pro creates a bond marketplace that utilizes Olympus DAO’s bonding mechanism. This bonding mechanism allows Olympus to own nearly 100% of its liquidity. Essentially, Olympus DAO receives the assets it needs for liquidity and gives the respective projects discounted OHM (Olympus DAO’s native token) in return. Similarly, projects can come to Olympus Pro and trade their native token at a discounted price in exchange for any asset they may need. Benefits of protocol owned liquidity include:

- Protocols own liquidity — Don’t have to worry about LPs dumping tokens. Don’t have to worry about attaining long term liquidity.

- Protocols unlock new revenue streams — Can capture liquidity provider fees themselves.

- Price stability and enhanced user experience — Larger amounts of liquidity allow the pool and protocol to support large trades with minimal slippage while removing the risk of significant liquidity exits.

Liquidity innovations — Sustainable Liquidity (Tokemak)

Tokemak is a decentralized market making protocol that aims to be a source of sustainable liquidity for DeFi. Here, users can deposit tokens and provide single-sided liquidity into Tokemak, and TOKE holders vote on where that liquidity should go. Liquidity providers can then earn TOKE from providing the single sided assets that are vetted through a whitelist. This is designed to be primarily used by:

- Liquidity providers and yield farmers: Users can deposit their assets into a reactor and earn yield in the form of TOKE tokens.

- DAOs: DAOs can utilize Tokemak’s liquidity to fuel their project through proper directing.

- New DeFi projects: New projects can create their own token reactors to generate healthy liquidity with Tokemak’s protocol controlled liquidity.

- Market Makers: Market makers can use the deep levels of liquidity in the network to direct it to their advantage.

- Exchanges: Can increase their market depth with Tokemak’s liquidity.

Raising additional capital

Variable rate products

DAOs can utilize lending protocols to lend out the assets in their treasury to earn interest. There are two types of interest — fixed and variable. Variable interest rates are determined by the relationship between the available liquidity in an asset pool and its demand. An increase in demand for a specific asset leads to higher variable interest rates for the ones providing the liquidity. Therefore, this can lead to higher returns than fixed rates.

Risk — Volatility in interest rates

Other than the expected risks in DeFi lending such as credit risk and smart contract risk, variable rate products consist of volatility in returns. As the interest rates are determined based on available liquidity and demand, the interest rates are subject to change. This may make it difficult to accurately forecast returns. However, this risk can be actively mitigated. For example, DAOs can participate in OTC interest rate swaps made by TradFi participants which will lower this risk.

Fixed rate products

Fixed rate lending protocols essentially use bonds to create fixed rate borrowing and lending. Benefits of fixed rate interest include:

- Predictable returns: No volatility because a predetermined rate is given, which is better for accurate budgeting and spending.

- Removes reinvestment risk: Reinvestment risk is the risk associated with the possibility that users will be unable to reinvest their gained interest at a rate equal to or greater than their current return. With variable rates, users are constantly looking for new places to invest their money to get a return higher than their current return due to its ever changing nature.

- Longer time frames: With fixed rate interest positions, users can confidently forget about their position and return for redemption when the maturity period has ended.

Element Finance

Element Finance allows DAOs to earn fixed rate yield on their treasury capital while maintaining the ability to easily exit if needed. Element allows the exchange of the discounted asset and base asset at any time.

Lido

Lido was created to prepare for the The Merge that will require staking of 32 ETH to earn staking rewards, which is an infeasible amount for small investors. Furthermore, the technical knowledge required to set up a staking node serves as a high barrier for most people. Lido allows DAOs to stake their treasury assets to earn daily staking rewards with no minimum amount required with no need to set up a staking node.

Conclusion: Act now

The two key issues for DAO treasuries are a lack of diversification and proper liquidity provisioning. Most DAO treasuries consist mainly of their native asset, which is subject to high volatility and vulnerable to steep downward trends in native token prices. When crypto bear markets come, these treasuries are at high risk due to their dependency on a singular, volatile asset. As a result, significant depletion of treasury sizes over a short period of time is not rare.

A stable treasury is necessary as similar, if not more, levels of spending are needed in bear markets to focus on growth. DAOs can go about acquiring assets with less volatility such as stablecoins to create treasuries resistant to the volatility. In this industry, liquidity is considered the new bandwidth as efficient liquidity is what enables assets to be seamlessly transferred. To achieve this, DAOs have used expensive and unsustainable methods such as traditional liquidity mining.

Today, innovative projects have created new methods that allow DAOs to reach their desired levels of token liquidity. Liquidity as a Service (i.e. Fei, Ondo), Protocol Owned Liquidity (i.e. Olympus Pro), and Sustainable Liquidity (i.e. Tokemak) allows DAOs to rent, buy, or even influence the direction of liquidity to their needs.

As DAOs experiment with old and new direct solutions to these issues, another consideration to make is the root of these problems. These problems emerge from the underlying mechanism of ERC-20 token issuances. New mechanisms (i.e. Nouns DAO’s NFT issuance) for ownership and distribution can help overcome some of these problems. Overall, properly tackling the problems of diversification and liquidity provisioning will give mission driven DAOs longer runways, allowing them to one day even compete with corporations.

References

https://shreyashariharan.com/2022/04/15/building-an-economy-within-a-dao/

https://shreyashariharan.com/2022/02/09/how-daos-can-diversify-into-stablecoins/

https://llama.mirror.xyz/0t6O19LAbdq_7p675Qinb4inhhrhreAQbLjbj4i9IIs

https://newsletter.banklesshq.com/p/liquidity-is-bandwidth?s=r

https://medium.com/blockchain-capital-blog/dao-treasury-balance-sheet-management-ce5e96da34ac

Thank you to Bruno Lulinski, Connor Spelliscy, Shreyas, Jacob Robsinon, David Kerr, and Kyler Wandler for providing feedback on this paper, and thank you to all of the researchers whose work we relied on while drafting this paper. Finally, thank you to the DAO Research Collective for their support.

The analysis contained in this article should not be construed as legal, business, tax or investment advice for any particular facts or circumstances and is not meant to replace competent counsel. None of the opinions or positions provided hereby are intended to be treated as legal advice or to create an attorney-client relationship. This analysis might not reflect all current updates to applicable laws or interpretive guidance and the authors disclaim any obligation to update this paper. It is strongly advised for you to contact a reputable attorney in your jurisdiction for any questions or concerns. For more information, see here.

In particular, this analysis explores optimal treasury management from the operational perspective of diversification and liquidity provisioning. Implementation of any ideas contained herein must comply with existing laws and regulations and it is strongly advised for you to contact a reputable attorney in your jurisdiction for any questions or concerns. The invitation to contact is not a solicitations for legal work under the laws of any jurisdiction.